Businesses tactics in a COVID19 world (Part 1 of 3)

Below is the first part of a 3-part series on what mainstreet businesses can do right now to shift their business in the changing COVID-19 environment.

If you’re stuck, reach out. CO+HOOTS is hosting weekly financial/legal information sessions to support personalized guidance during this time. We are here for you. Learn more here: bit.ly/eventsatco

—-

Thirty-eight years ago, my parents opened Camdi Restaurant, a small Chinese-Vietnamese restaurant named after my mom in downtown Minneapolis. It has been open consistently until two weeks ago when, for the first time ever, the restaurant was mandated to close dine-in service. My parents have since lost nearly 75% of their income.

As I caught up with my mom that evening, I realized there is so much she should be doing. But no one is guiding her as a small restaurant owner. Add on language barriers and not used to asking for help (a cultural trait), her challenges are compounding. I asked if she has requested help from her utility company, or from the banks that carry any of the loans she had. “No,” she said, “I don’t even know how I would start doing that. Can I do that?”

The story is similar to many other small business owners I’ve chatted with over the last week. The panic is real and, unfortunately, government support is still several weeks out. I fear we are facing the mass decimation of our main street businesses if we don’t help them make changes now, especially those from underrepresented communities.

I am not a financial expert or legal advisor, but I founded a coworking/incubator space called CO+HOOTS in the middle of the last recession and have supported nearly a thousand entrepreneurs over the last decade, of those businesses 80% survived the last recession and have grown and thrived. While not comprehensive to all businesses, I hope the following steps can be helpful to many mainstreet businesses who may be paralyzed, questioning if they need to prepare to close their doors and just walk away or hang in a little longer.

An overwhelming weight of uncertainty hangs over us all, myself included, but there are steps to weather this storm and potentially even benefit from it. Together, my mom and I worked on the tactical steps she could implement immediately to buy her some time until the government’s stimulus package rolls out or until she could work out a new revenue model.

We talked through her highest expense items and identified next steps to lower her burn rate. You can find the worksheet we quickly put together in the link below. If you’re like mom, you also needed some guidance on how to negotiate with partners. With the help of Amber Cordoba, manager of consulting services for Chicanos Por La Causa, the following script was developed to help small businesses with beginning the discussions. Feel free to take, edit and revise for your needs.

Hello [NAME], As you may know, my business [BIZ NAME] was mandated to close due to COVID-19. This has caused an incredible loss of business resulting in financial hardship in a very short amount of time. We’ve seen an xx% loss of revenue since [DATE] and are doing everything we can to maintain operations and mitigate costs. I’m reaching out to see if [COMPANY/NAME] has any ability to help me in this difficult time. I can likely [INSERT OFFER/ASK — Could be 50% reduction, a 2-3 month deferral, interest only payments, to cancel a subscription, revenue share, or just ask for help and let them respond]. This would allow us to keep employees paid until we can pivot to new revenue strategies. Thank you in advance.

PART 1: Mitigate costs

(Estimated time to complete: 1 hour)

Begin by listing all your expenses and addressing what areas can be negotiated down, waived or canceled. Now is the time to get lean. If you’re lean already, get leaner. You want to be the ground beef that is only 2% fat (which is ironically more expensive).

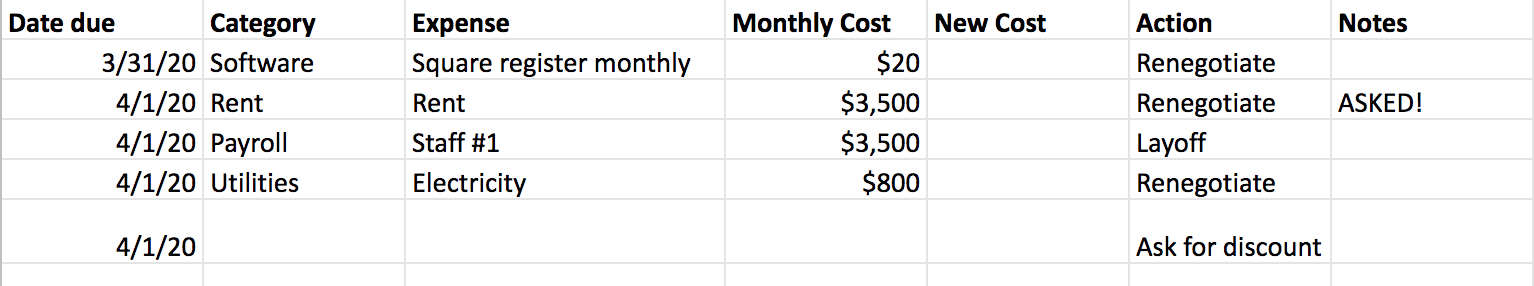

1. List all your business expenses. It might be easiest to start with your biggest expenses first. (Here is a simple spreadsheet to start filling in if you need help: https://docs.google.com/spreadsheets/d/1z7HQhSMIVpe3LT7wW1FaUUySaJT2FH9ErVZrmszIzy4/edit?usp=sharing).

Main columns: Category, Monthly Cost, Action, Notes. Your “Actions” should be either: Freeze/Pause, Renegotiate, Cancel, or Keep.

2. Once you’ve documented your expenses, prioritize your most expensive costs (you should sort the columns now). Begin your emails, calls, outreach to these vendors to lower or eliminate costs. Track these in the “Action” column.

Pro Tip: You can negotiate everything. Are you renting or paying utilities to your city municipality? City of Tempe has done a great job of quickly finding ways to support small businesses like abating all rent on property they own.

3. Staff, this is a tough one. No one wants to let staff go, but if you don’t have customers, you can’t sustain staff.

Pro Tip: Pay payroll tax first, this tax comes with the highest fees if you miss it.

Note: The federal government’s new stimulus package includes small business loans that can be forgiven if you keep your staff on payroll through June, keep watching the news as information is being released daily.

4. Check if your vendors and partner costs can be lowered. Are you paying for software or services you won’t be using through this crisis? (Ex. do you pay a monthly fee for banking or payroll?)

5. Map the projected new expenses against the projected new revenue (for my parents, they suddenly saw a drop of 75% of their revenue) and see if you get in the black.

Do this again for your personal expenses. (Student loans? Car payments? Home loans? Utility bills? Internet bills?) Reducing your personal expenses will help you also stay afloat.

Lastly, as you begin negotiating or canceling with vendors, partners and staff, realize everyone is struggling. Your hope is to get leeway where you can from people who can give you that. Realize not everyone can. Patience and empathy are required from all right now if we are to get through this together.

If you’re stuck, reach out. CO+HOOTS is hosting weekly advisor/legal sessions. We are here for you. Learn more here: bit.ly/eventsatco

We also aren’t the only ones. Below are some other resources for small businesses.

Costarters: https://costarters.co/recovery/

Godaddy: https://www.openwestand.org/

StartupSpaces: https://www.startupspaces.com

SBA: https://www.sba.gov/learning-center

CPLC: https://www.prestamosloans.org/covid-19-information-resources/

Local First: https://www.localfirstaz.com/covidresources

UP NEXT Part 2: Generating Revenue